Contact us now for your demand[email protected]

- Products

- Calorimeter

- Elemental Analyzer

- 5E-S32 Series Sulfur Analyzer

- 5E Series C/H/N Elemental Analyzer

- 5E-TCN2200 Nitrogen/Protein Analyzer

- 5E-IRS3600 Automatic Infrared Sulfur Analyzer

- 5E-IRSII Infrared Sulfur Analyzer

- 5E-CS3800 Sulfur Carbon Analyzer

- 5E-CS3700 Inorganic Carbon Sulfur Analyzer

- 5E Series Fluorine/Chlorine Analyzer

- 5E-DMA Series Direct Mercury Analyzer

- 5E-AA2288 Automatic Cadmium Analyzer

- EDXRF Spectrometer & Pretreatment

- Proximate Analyzer

- 5E-TGA6720A Thermogravimetric Analyzer-TGANEW!

- 5E-TGA6720 Thermogravimetric Analyzer-TGANEW!

- 5E-MAC6710 Proximate Analyzer/Thermogravimetric Analyzer - TGA

- 5E-MF6100K Muffle Furnace

- 5E-MW6513 Automatic Moisture Analyzer

- 5E-MIN6150 Mini Moisture Oven

- 5E Series Drying Oven

- 5E-MW Series Automatic Moisture Analyzer

- TGM226 Automatic Moisture Analyzer

- 5E-MA27 Series Automatic Moisture and Ash Analyzer

- Ash Fusion Determinator

- Coking Coal Indices Determinator

- Hardgrove Grindability Index Tester

- Sample Preparation Equipment

- 5E-SDCSIII Dust-Removing System

- 5E-PA Series Sample Preparation Combination Apparatus

- 5E-APS Automatic Sample Preparation System

- 5E-HCB Series Hammer Crusher

- 5E-HCA400×260 Humid Coal Hammer Crusher

- 5E-JCA Series Jaw Crusher

- 5E-DCA250×150 Double Roller Crusher

- 5E-PCM Series Pulverizer

- 5E Series Sample Divider

- 5E-SSB200 Sieving Shaker

- 5E Series Assisting Tools

- Mechanical Sampler

- Management System

- Robotic Intelligent Laboratory System

- spare parts

- Application

- news

- support

- company

- contact

Liebherr crawler tractor PR 776 in a coal mine in Australia.

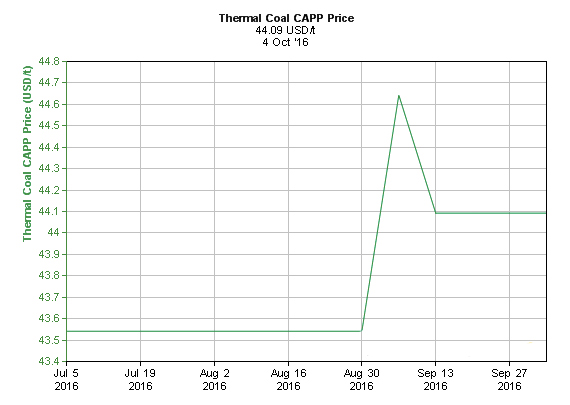

Liebherr crawler tractor PR 776 in a coal mine in Australia. But NAB’s chief economist, Alan Ostler, disagrees. He told The Guardian this week the rise in thermal coal price is unsustainable, adding that global production peaked in 2014, which together with action on setting a carbon price following agreement on the Paris climate accord will continue to suppress demand.

But NAB’s chief economist, Alan Ostler, disagrees. He told The Guardian this week the rise in thermal coal price is unsustainable, adding that global production peaked in 2014, which together with action on setting a carbon price following agreement on the Paris climate accord will continue to suppress demand.